Linear Regression – Assumption- 2 (How To Detect & Avoid Multicollinearity ?)

Table Of Contents:

- How To Detect Multicollinearity In The Dataset ?

- Correlation Matrix.

- Variance Inflection Factor

- Model Behavior Observation.

- How To Avoid Multicollinearity In The Dataset ?

- Remove One of the Correlated Variables

- Use Principal Component Analysis (PCA)

- Use Regularization Techniques (Ridge/Lasso)

(1) How To Detect Multicollinearity In The Dataset?

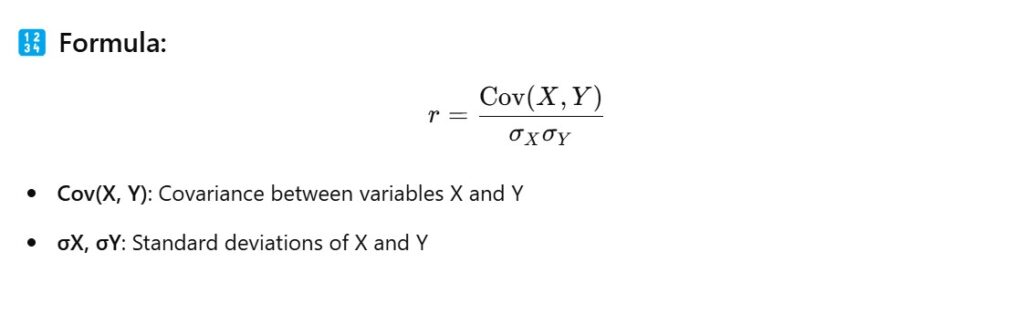

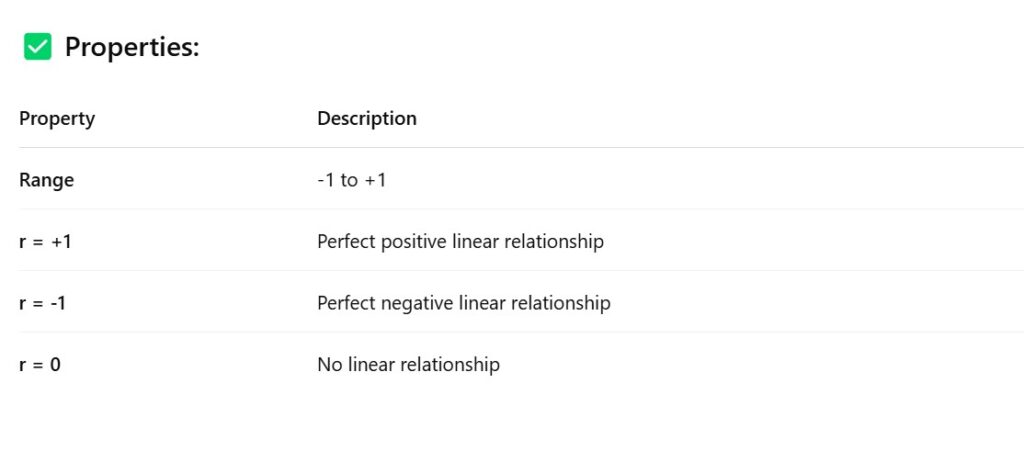

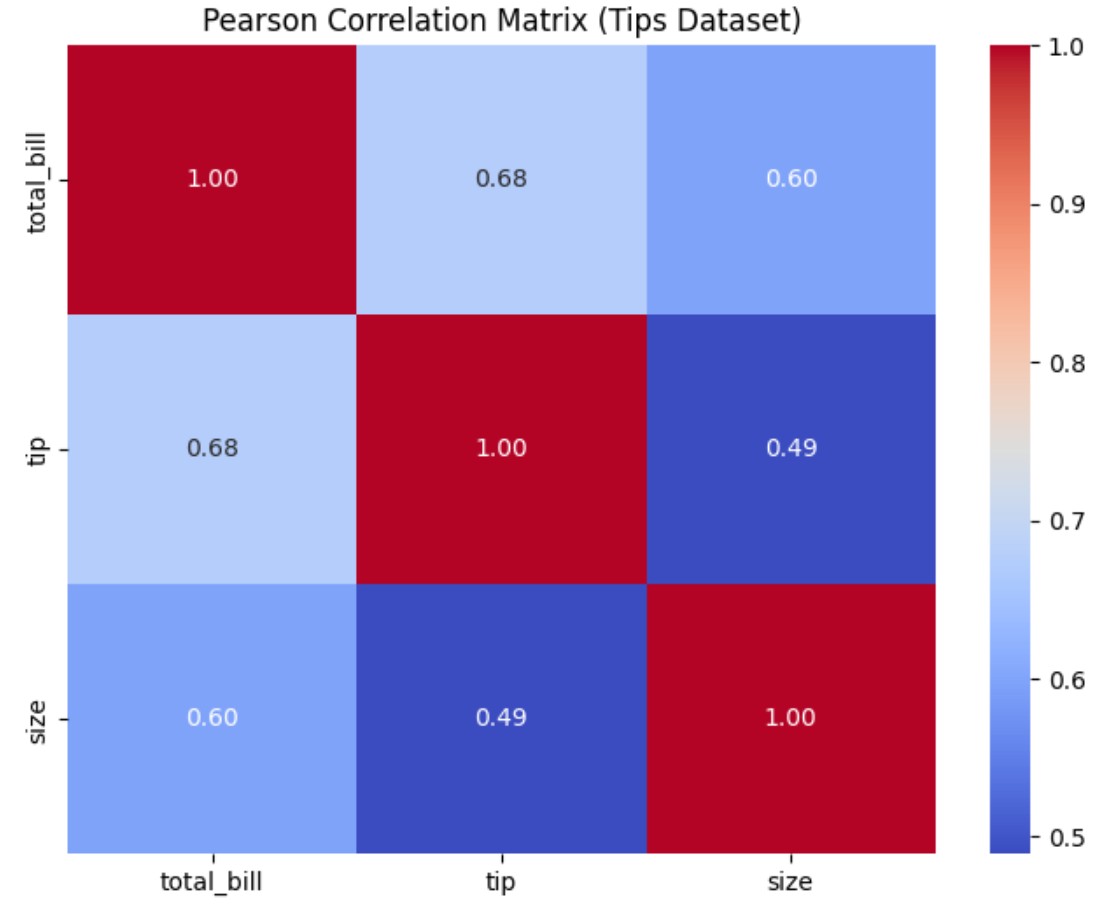

Method – 1: Correlation Matrix (Pearson correlation)

- We will use Pearson ‘r’ Correlation Coefficient to find the correlation between two variable.

import seaborn as sns

import matplotlib.pyplot as plt

# Load dataset

tips = sns.load_dataset("tips")

# Compute the Pearson correlation matrix

corr_matrix = tips.corr(numeric_only=True)

# Create heatmap

plt.figure(figsize=(8, 6))

sns.heatmap(corr_matrix, annot=True, cmap='coolwarm', fmt=".2f")

# Styling

plt.title("Pearson Correlation Matrix (Tips Dataset)")

plt.show()

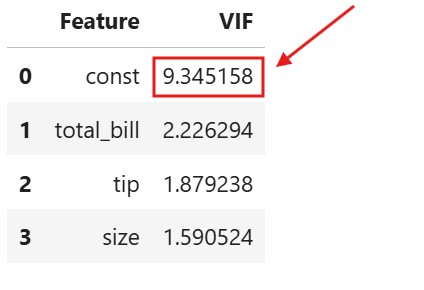

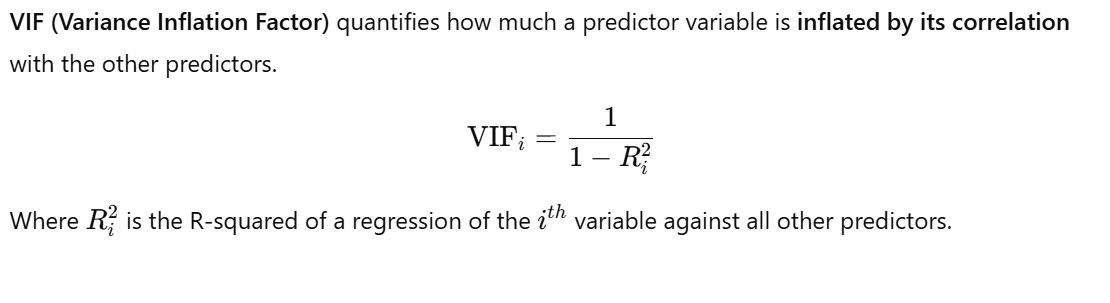

Method – 2: Variance Inflation Factor (VIF)

import pandas as pd

import seaborn as sns

import statsmodels.api as sm

from statsmodels.stats.outliers_influence import variance_inflation_factor

# Load dataset

tips = sns.load_dataset('tips')

# Select relevant numerical features (exclude categorical)

df = tips[["total_bill", "tip", "size"]]

# Add a constant term for intercept

df_with_const = sm.add_constant(df)

# Calculate VIF for each feature

vif_data = pd.DataFrame()

vif_data["Feature"] = df_with_const.columns

vif_data["VIF"] = [variance_inflation_factor(df_with_const.values, i)

for i in range(df_with_const.shape[1])]

print(vif_data)

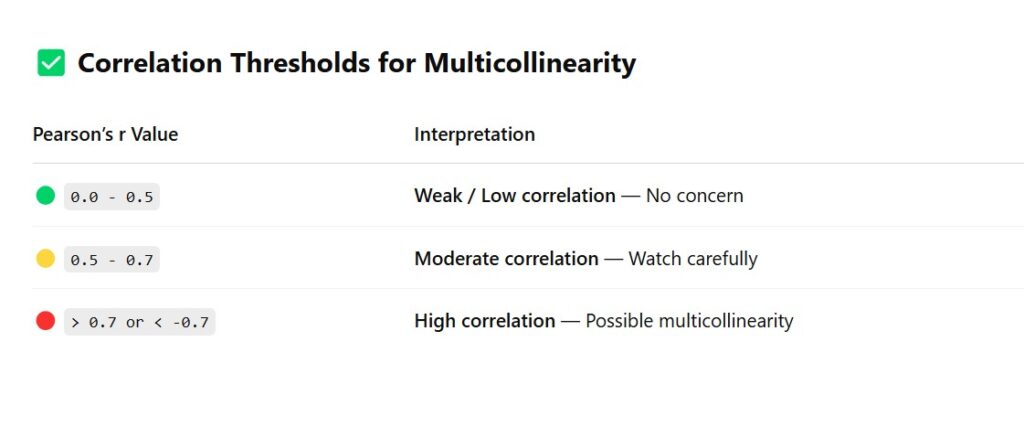

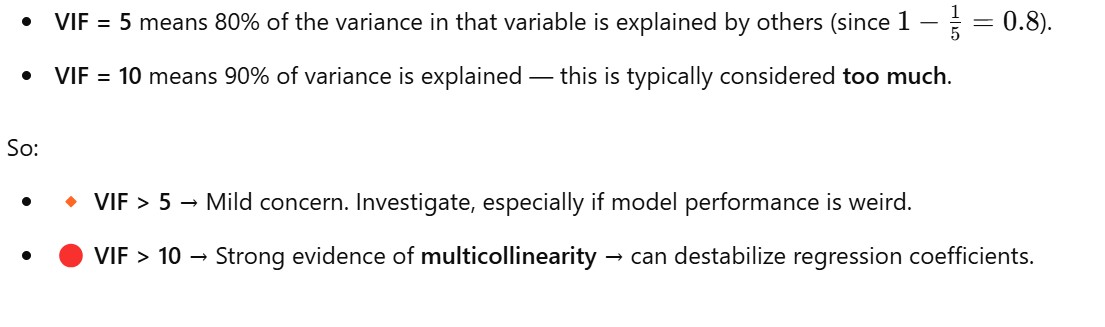

- Why we use the lower limit as 5 and upper limit as 10 ?

- For VIF = 5, R-Squared = 0.80, which means 80 % of the variance present in the dependent variable is explained by all the independent variable.

- For VIF = 10, R-Squared = 0.90, which means 90 % of the variance present in the dependent variable is explained by all the independent variable.

Method – : Model Behavior

- You have two features,

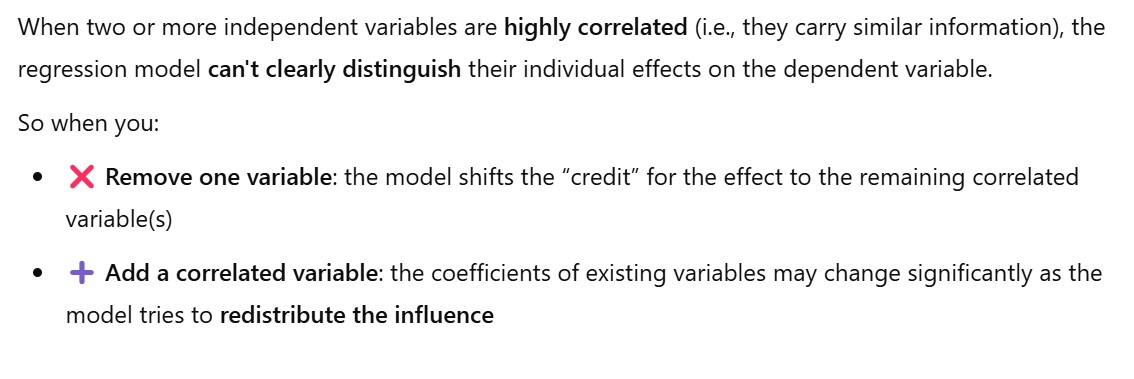

X1andX2, that are highly correlated. They’re both providing very similar information to the model. - So when the model fits: It’s hard to know how much weight (coefficient) to give to

X1andX2, because changing one’s value affects the other. - This causes multicollinearity, and the model starts “splitting the credit” between them in a shaky way.

- Note: After giving the unstable weights to the two variable, if you remove one variable (x2) its credit or contribution will go to other correlated variable (x1).

- Hence its weight will drastically increase or decrease. With a large unit.

- Question: Now the question is why the weight not got distributed to other non correlated variable ?

- Answer:

X1andX2shared a lot of overlapping info. When you removeX2, that info still exists inX1. So the model naturally adjusts the coefficient ofX1to account for that extra explanation. It’s not that the effect “jumps” toX1, but rather that the shared information already exists inX1— so the model just leans more heavily on it. Only the unique variance that was explained only by

X2(and not byX1) gets pushed to the residual/error term.But if

X1andX2are, say, 90% correlated, then removingX2doesn’t hurt the model much — becauseX1is doing almost the same job.

(2) How To Avoid Multicollinearity In The Dataset ?

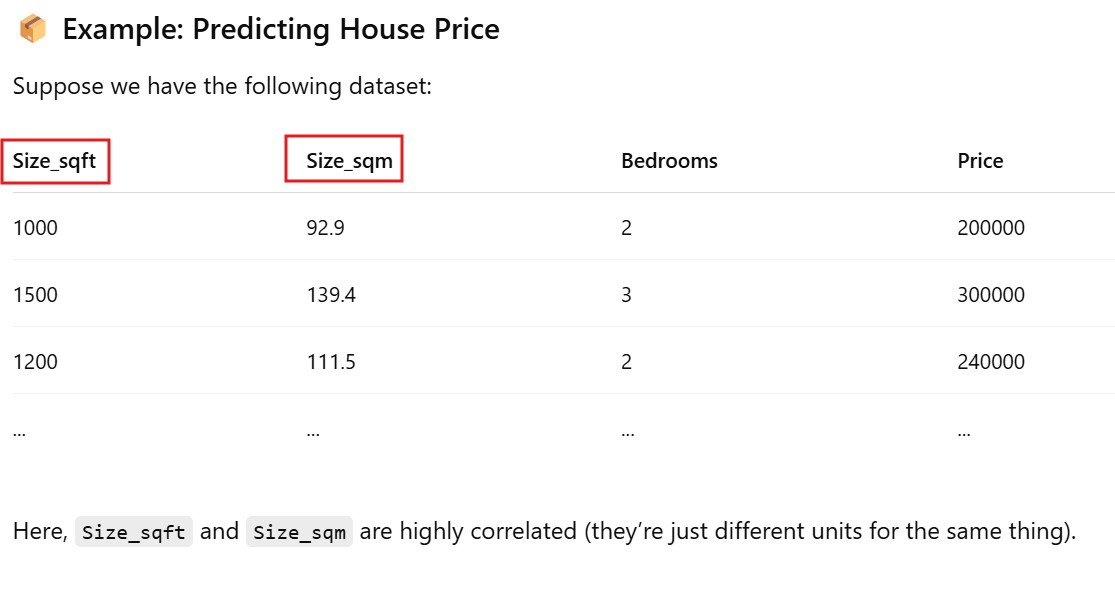

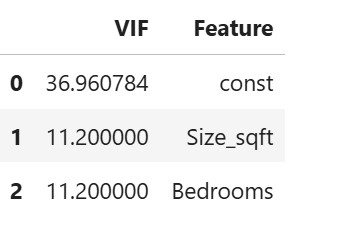

Method – 1: Remove One of the Correlated Variables

- Best When: Two or more variables have high correlation (Pearson’s r > 0.7 or VIF > 5/10), and you can justify removing one based on domain knowledge.

import pandas as pd

from statsmodels.api import OLS, add_constant

from statsmodels.stats.outliers_influence import variance_inflation_factor

# Sample data

data = pd.DataFrame({

'Size_sqft': [1000, 1500, 1200, 1800, 1600],

'Size_sqm': [92.9, 139.4, 111.5, 167.2, 148.6],

'Bedrooms': [2, 3, 2, 4, 3],

'Price': [200000, 300000, 240000, 360000, 320000]

})

# Features and target

X = data[['Size_sqft', 'Size_sqm', 'Bedrooms']]

y = data['Price']

# Add constant

X_const = add_constant(X)

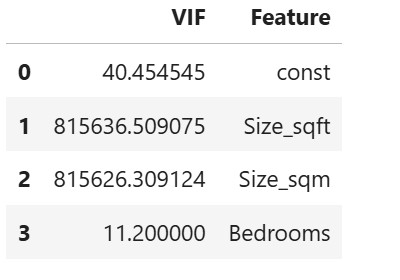

# Check VIF

vif = pd.DataFrame()

vif["VIF"] = [variance_inflation_factor(X_const.values, i) for i in range(X_const.shape[1])]

vif["Feature"] = X_const.columns

print(vif)

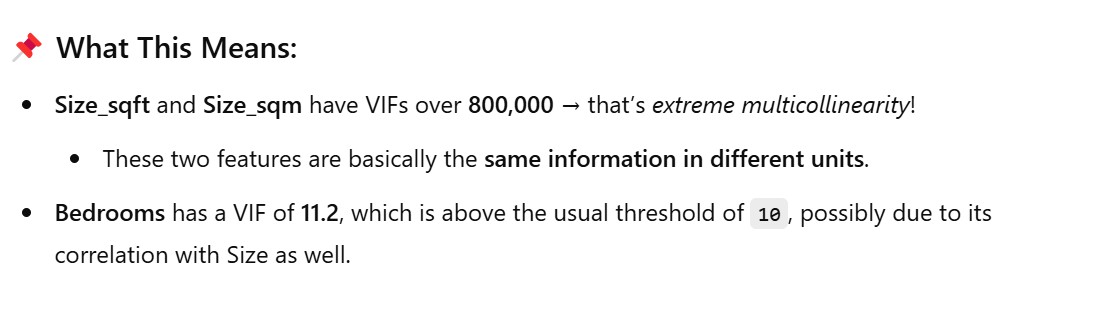

# Drop one of the correlated features

X_reduced = data[['Size_sqft', 'Bedrooms']] # Removed 'Size_sqm'

# Refit model or calculate new VIF

X_const = add_constant(X_reduced)

vif = pd.DataFrame()

vif["VIF"] = [variance_inflation_factor(X_const.values, i) for i in range(X_const.shape[1])]

vif["Feature"] = X_const.columns

vif

Method – 2: Use Principle Component Analysis(PCA)

Step 1: Import Libraries & Create a Dataset with Multicollinearity

import numpy as np

import pandas as pd

from sklearn.decomposition import PCA

from sklearn.preprocessing import StandardScaler

from sklearn.linear_model import LinearRegression

from sklearn.model_selection import train_test_split

# Create synthetic dataset with multicollinearity

np.random.seed(42)

X1 = np.random.rand(100) * 100

X2 = X1 + np.random.normal(0, 1, 100) # Strongly correlated with X1

X3 = np.random.rand(100) * 50

# Target variable

y = 5 + 2 * X1 + 3 * X3 + np.random.normal(0, 10, 100)

# Create DataFrame

df = pd.DataFrame({'X1': X1, 'X2': X2, 'X3': X3, 'y': y})

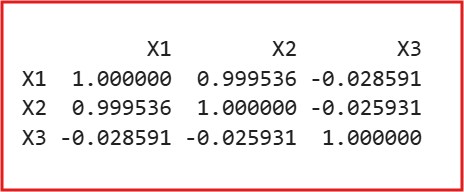

Step 2: Check Correlation Matrix (to confirm multicollinearity)

print(df[['X1', 'X2', 'X3']].corr())

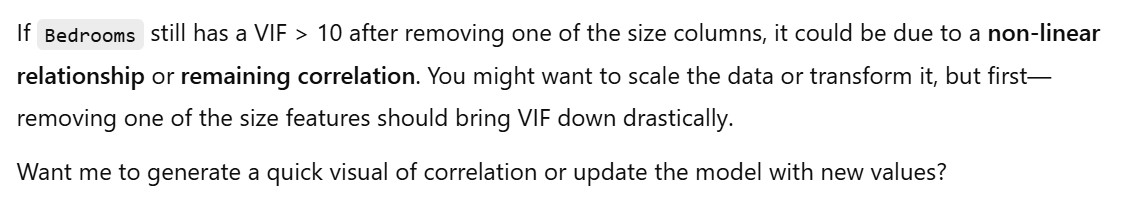

- You’ll notice that X1 and X2 have correlation close to 1.0 (strong multicollinearity).

Step 3: Standardize the Data

scaler = StandardScaler()

X_scaled = scaler.fit_transform(df[['X1', 'X2', 'X3']])

Step 4: Apply PCA

pca = PCA()

X_pca = pca.fit_transform(X_scaled)

# View explained variance to decide how many components to keep

print(pca.explained_variance_ratio_)

- You’ll likely see that first 2 components explain >95% of variance.

Step 5: Use Principal Components in Regression

# Keep only first 2 principal components

X_final = X_pca[:, :2]

# Train-test split

X_train, X_test, y_train, y_test = train_test_split(X_final, df['y'], test_size=0.2, random_state=42)

# Fit regression model

model = LinearRegression()

model.fit(X_train, y_train)

# Predict & evaluate

score = model.score(X_test, y_test)

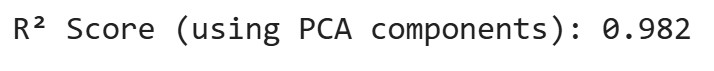

print(f"R² Score (using PCA components): {score:.3f}")

Step 6 : Without Principal Components in Regression

from sklearn.linear_model import LinearRegression

from sklearn.model_selection import train_test_split

# Define features and target

X_original = df[['X1', 'X2', 'X3']]

y = df['y']

# Split the data

X_train, X_test, y_train, y_test = train_test_split(X_original, y, test_size=0.2, random_state=42)

# Train the model

model_original = LinearRegression()

model_original.fit(X_train, y_train)

# Evaluate R² score

r2_original = model_original.score(X_test, y_test)

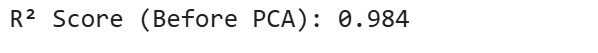

print(f"R² Score (Before PCA): {r2_original:.3f}")

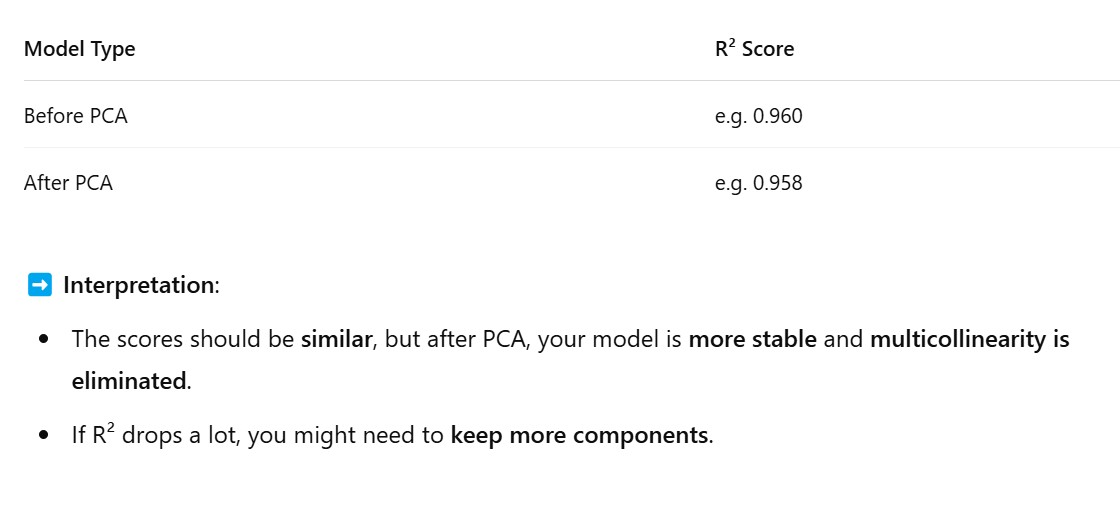

Step 6 : Before And After PCA Comparison

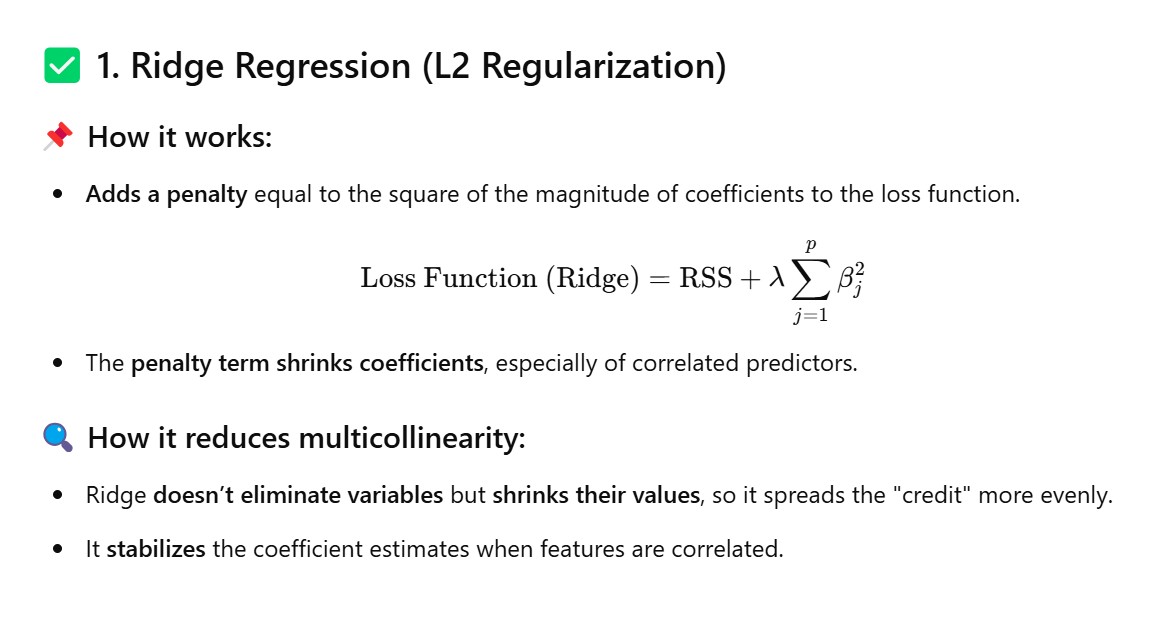

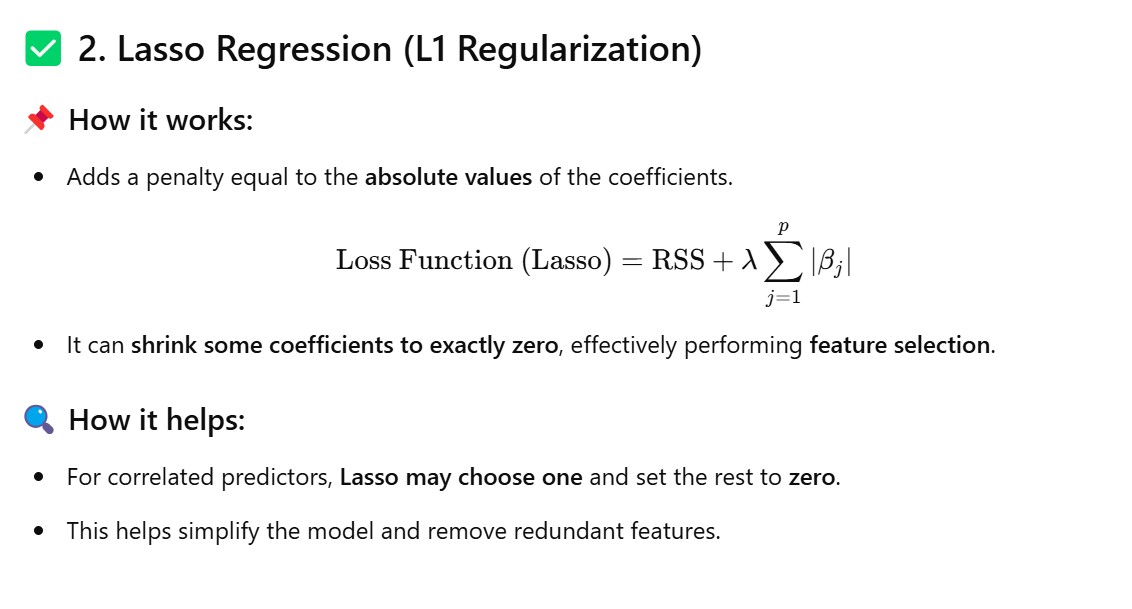

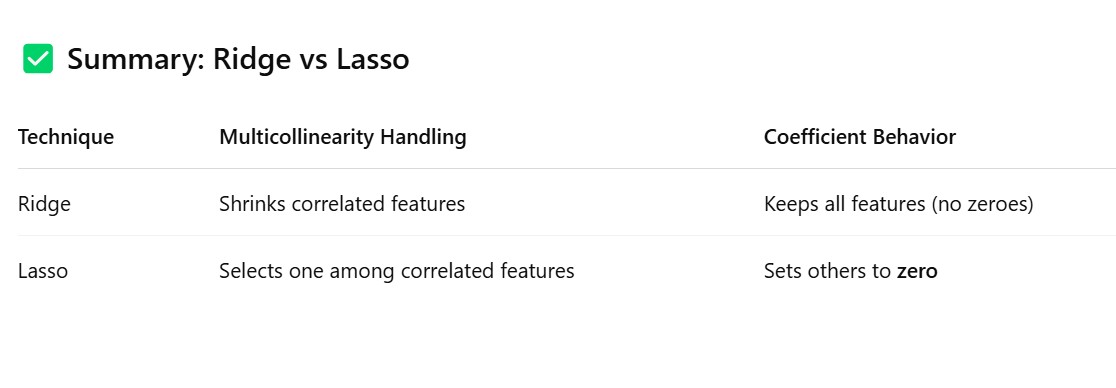

Method – 3: Use Regularization Techniques (Ridge/Lasso)

from sklearn.linear_model import Ridge

from sklearn.model_selection import train_test_split

from sklearn.metrics import r2_score

import pandas as pd

import numpy as np

# Create synthetic correlated data

np.random.seed(0)

X1 = np.random.rand(100)

X2 = X1 * 0.95 + np.random.rand(100) * 0.05

X3 = X1 * 0.9 + np.random.rand(100) * 0.1

y = 3*X1 + 2*X2 + np.random.rand(100)

X = pd.DataFrame({'X1': X1, 'X2': X2, 'X3': X3})

# Train Ridge model

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2)

ridge = Ridge(alpha=1.0)

ridge.fit(X_train, y_train)

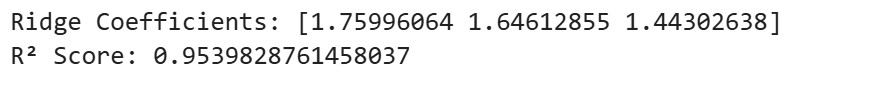

print("Ridge Coefficients:", ridge.coef_)

print("R² Score:", r2_score(y_test, ridge.predict(X_test)))